To recover their money lenders started the bidding of Ruchi. Patanjali, Adani-Willmer, Godrej were in the race to bid the highest. Earlier Patanjali emerged out to be highest bidder with amount of Rs. 5700 crore. Seeing this Adani raises its cost to Rs. 6000 Crore.Although Patanjali have swiss challenge method to rebid. But till now Patanjali have not responded to Ruchi for further bidding

Ruchi Soya case- Journey from beginning to end

Sunday, June 24, 2018

New plan of Ruchi

In 2016 someone filled a petition in Bombay High Court demanding its money back but court refused and told that the company has had a temorary setback and is making a sincere attempt of its rival with the assistance of large number of creditors. So it would not be desirable and in the interest of all the creditors including the petitioners .

NEW PLANS

Satendra Aggarwal the COO of Ruchi shared a plan of launching edible oils in all sectors. and more focus on nutrela and other food products.

Adani joined hands with Ruchi to help her out. The objective of joint venture(JV) was to sell retail products jointly but it also failed because they didn't receive NOC certificate from various bank

NEW PLANS

Satendra Aggarwal the COO of Ruchi shared a plan of launching edible oils in all sectors. and more focus on nutrela and other food products.

Adani joined hands with Ruchi to help her out. The objective of joint venture(JV) was to sell retail products jointly but it also failed because they didn't receive NOC certificate from various bank

The

ruling, offering respite to Ruchi Soya, noted that the company has had

“a temporary setback and is making a sincere attempt of its revival with

the assistance of large number of the creditors. So it would not be

desirable and in the interest of all the creditors including the

petitioner to pass any order of winding up against the

respondent-company at this stage”.

Read more at:

//economictimes.indiatimes.com/articleshow/58197902.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

//economictimes.indiatimes.com/articleshow/58197902.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

The

ruling, offering respite to Ruchi Soya, noted that the company has had

“a temporary setback and is making a sincere attempt of its revival with

the assistance of large number of the creditors. So it would not be

desirable and in the interest of all the creditors including the

petitioner to pass any order of winding up against the

respondent-company at this stage”.

The

ruling, offering respite to Ruchi Soya, noted that the company has had

“a temporary setback and is making a sincere attempt of its revival with

the assistance of large number of the creditors. So it would not be

desirable and in the interest of all the creditors including the

petitioner to pass any order of winding up against the

respondent-company at this stage”.

Further troubles and losses

Till now we have seen what are the reasons for Ruchi's downfall, now we will look at some more further which were waiting for Ruchi.

TROUBLES

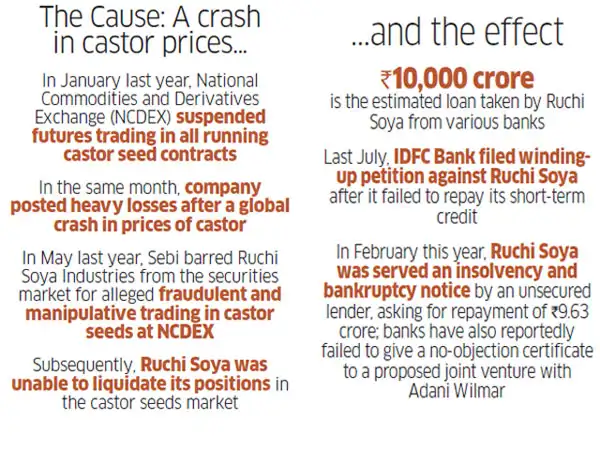

In 2016, IDFC bank filled a petition against Ruchi Soya after it failed to repay its short term credit. In 2017, company got insolvency and bankruptcy notice and even share prices fell from Rs. 93 to Rs. 25

FINANCIAL & CORPORATE SUPPORT

Ruchi tied up with Patanjali and started supplying for it even invested some crores in it. Due to this, Ruchi once again came back on track and started gaining profit. It gained profit for about 8 months.

REITERATIVE LOSS

After running 8 months on track Ruchi Express again derailed. Due to excess monsoon followed by 2 droughts drastically brought down the soya cultivation. Import of oil from Malaysia and Indonesia and some unfavorable government policies added much woes to it.

SHADOW OF DARKNESS

Fall in global prices of castor seeds made NCDEX to suspend future trading. SEBI also barred Ruchi for fraudulent and manipulative trading castor seeds. Due to this , large part of of their net worth got eroded and Ruchi couldn't restore its position in the market

pic source: google

TROUBLES

In 2016, IDFC bank filled a petition against Ruchi Soya after it failed to repay its short term credit. In 2017, company got insolvency and bankruptcy notice and even share prices fell from Rs. 93 to Rs. 25

FINANCIAL & CORPORATE SUPPORT

Ruchi tied up with Patanjali and started supplying for it even invested some crores in it. Due to this, Ruchi once again came back on track and started gaining profit. It gained profit for about 8 months.

REITERATIVE LOSS

After running 8 months on track Ruchi Express again derailed. Due to excess monsoon followed by 2 droughts drastically brought down the soya cultivation. Import of oil from Malaysia and Indonesia and some unfavorable government policies added much woes to it.

SHADOW OF DARKNESS

Fall in global prices of castor seeds made NCDEX to suspend future trading. SEBI also barred Ruchi for fraudulent and manipulative trading castor seeds. Due to this , large part of of their net worth got eroded and Ruchi couldn't restore its position in the market

pic source: google

Saturday, June 23, 2018

Reasons of downfall

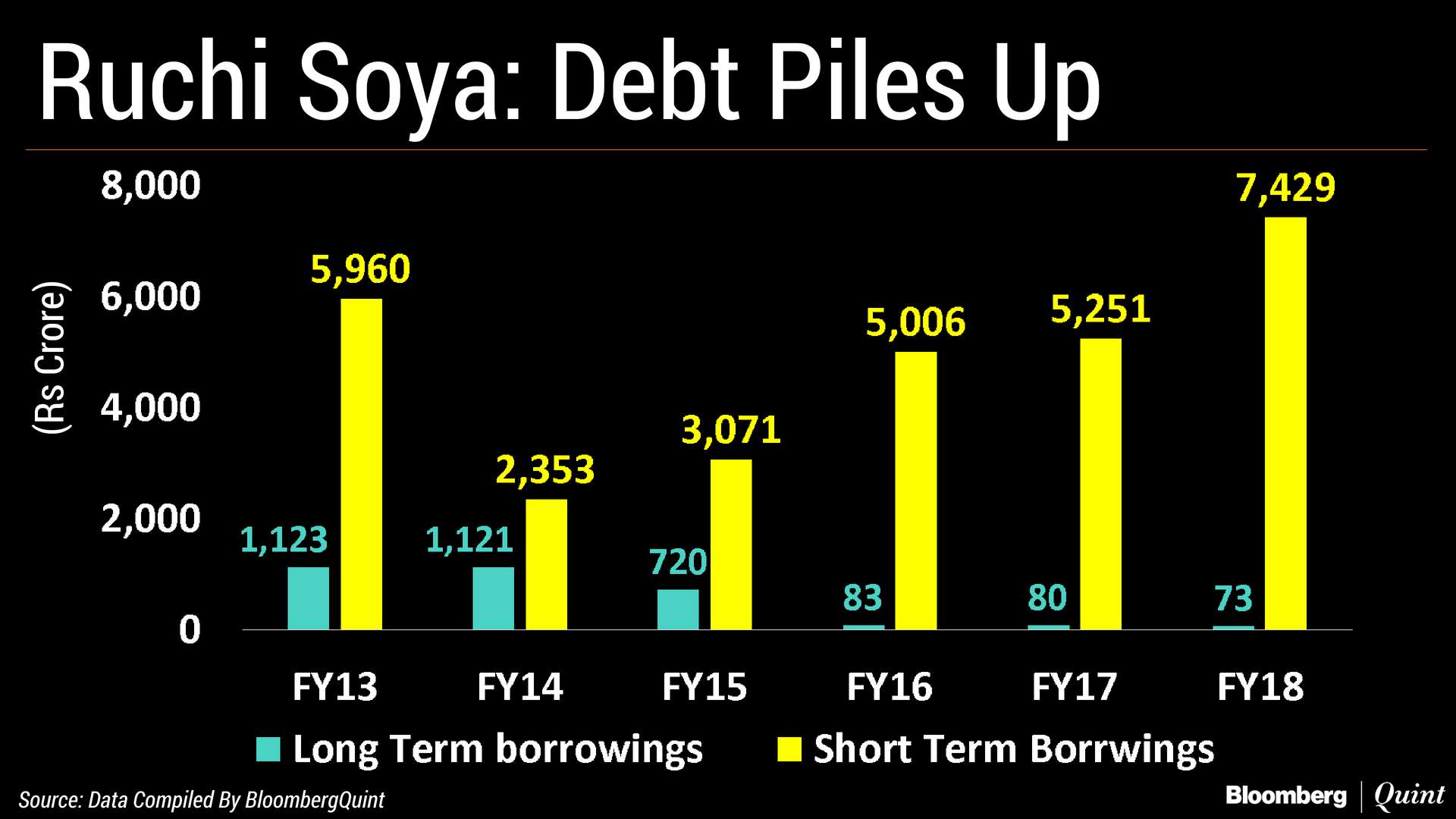

Castor oil selling turned to be its biggest scourge. Ruchi's strongest desire to sell castor seeds on the commodities exchange was its major cause of downfall. Due to fall in global prices of castor seeds from Rs 5100/quintal in January 2015 to Rs. 3051/quintal in January 2016, Ruchi incurred a loss of Rs. 878.7 crores. It was the first time since its inception, it suffered a loss. Debt increased from Rs. 2568 crores to Rs. 4513 crores in 2 years as it has taken loans from lenders and various banks. Now investors started demanding their money to recover their dues which was Rs. 10,000 crores.

The following bar-graph shows Ruchi's short term and long term borrowing from FY13 to FY18

pic source: Google

The following bar-graph shows Ruchi's short term and long term borrowing from FY13 to FY18

pic source: Google

Friday, June 22, 2018

ruchi soya beginning

Hi all today I will tell some interesting facts about that company whose name you might have heard or not but I am damn sure that you all have consumed its product. Yes!! It is none Other than Ruchi Soya, the company whose Nutrela (Soya Chunks) you are found of.

So now lets begin:

It is a FMCG company which produce many things like soya, edible oils, pluses etc. Nutrela is its largest selling brand with more than 50% of indian market share. It started its business from Nutrela brand in 1980 and later on spread its business.It was the largest edible oil maker in pan India.

So here was some information about Ruchi Soya. In the upcoming part we will know more about its journey.

NOTE:- If you are using this site on mobile then please click on home tab given at the bottom of the page to read its other parts.

So now lets begin:

It is a FMCG company which produce many things like soya, edible oils, pluses etc. Nutrela is its largest selling brand with more than 50% of indian market share. It started its business from Nutrela brand in 1980 and later on spread its business.It was the largest edible oil maker in pan India.

So here was some information about Ruchi Soya. In the upcoming part we will know more about its journey.

NOTE:- If you are using this site on mobile then please click on home tab given at the bottom of the page to read its other parts.

Subscribe to:

Comments (Atom)